What is a hedge fund?

A hedge fund is an investment vehicle which makes money by buying things and marking them up.

Wait–isn’t that the same business model as my local supermarket?

Almost exactly! One tiny difference is that your supermarket actually has to sell the things they buy, while the hedge fund makes money just by marking them up.

Sort of like a hedge fund.

How do they do that? They can’t just make up the prices, can they?

No, that would be illegal. They have to pay other people to make them up.

What if the hedge fund owns illiquid securities that trade only infrequently? How are those priced?

From January through November, the value of the portfolio is established by independent third-party pricing services and arms-length neutral practitioner input. Rigorous procedures are then applied to this outsourced data. These procedures require the application by highly educated professionals of a complex financial algorithm, or “model”, which is based on the mathematical characteristics of the individual holdings.

OK, what about December?

That’s called the “year-end mark”, and it’s determined in much the same way except that for year-end marks, the arms-length independent highly educated outsourced neutral third-party pricing data professionals employ a model that is based upon the compensation requirements of the hedge fund manager.

Pricing the year-end portfolio.

So what are these “things” that hedge funds buy?

Hedge funds mostly buy stocks, which are certificates that represent the underlying equity of a company; bonds, which are notes that represent the debt of a company; and derivatives, which are table napkins that represent the life savings of the hedge fund’s investors.

What’s so special about a napkin?

Nothing, until the hedge fund manager gets drunk and scribbles on it.

Such as?

“I, Chip ‘Buzz’ Chipley (hereinafter “CBC”, “Buzz”, or “Chipper”), manager of the Purple Haze Global Do Whatever I Want Fund (“PHGDWIWF”, or “The Fund”, or “Chipper’s Piggy Bank”), hereby wager 100 million dollars ($100,000,000) of PHGDWIWF investors’ money, which doesn’t include any of My Own Money (“MOM”), that Mortgage Interest Rates As Published By The Federal Housing Authority (“MIRAPBTFHA”) will rise by 1 percentage point Before Next Friday (“BNF”). It is hereby stipulated that even if I lose this bet and my fund blows up, I will get a better job and I Will Be Paid Even More Next Year Than I Was Paid This Year (“IWBPEMNYTIWPTY”).”

Trading derivatives.

What’s with the acronyms?

Often only a small cocktail napkin is available.

Who’s on the other side of the bet?

Somebody that the hedge fund manager has just met at the jello-shot counter at a big hedge fund party, thus referred to as a “counter-party”. The counter-party might be another hedge fund manager, or it might be anybody who has a hundred million dollars, a napkin, and a missing frontal lobe.

How does the hedge fund manager know that the counter-party will pay up if he loses the bet? And vice versa?

Our capital markets and our entire financial system are built on a foundation of trust and integrity. Hedge fund managers would rather lose their hundred-million-dollar jobs than suffer the private disgrace of having failed to live up to a contract. Ultimately, for hedge fund managers, personal honor and doing the right thing are far more important than financial gain. No hedge fund manager would ever renege on a trade, not even a trade that loses a fortune.

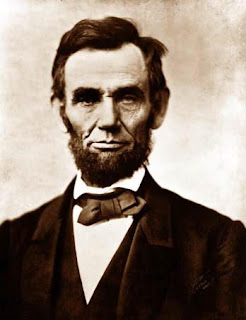

Hedge Fund Manager Role Models

What if he thought he could get away with it?

Sorry, but you can’t put a price on integrity. If you could, it would be around $20 million.

Do hedge funds deliver good long-term performance?

Quarter after quarter, year after year, hedge funds realize consistent above-market risk-adjusted returns.

What are stars?

Stars are little holes in the tapestry that covers the sky.

And hedge fund investors— do they do well?

Investors in hedge funds always get wealthier thanks to the better-than-market performance of hedge funds.

Always?

Yes, unless they actually need their money back.

Hedge Fund Investors Cash Out.

What’s the procedure?

Hedge funds follow a standardized process for investor liquidity. On the first rainy Thursday following any total solar eclipse in a year in which the NFC team wins the Super Bowl by more than three touchdowns (including two safeties), the investor may send a handwritten letter to his Congressman, along with a check to cover “incidentals”, requesting a withdrawal of his hedge fund investment. The Congressman then writes the investor’s request into pending environmental legislation. Once the bill passes Congress, it goes to the states, which have seven years to approve the request. Following such approval, the House Bursar instructs the Comptroller of the Currency to cut the investor a check for his full participation in the fund less any travel expenses incurred by members of the House Finance Committee and less management fees (typically lower than 100%).

Sounds complicated.

It is. That’s why the Securities And Exchange Commission working with the City of New York recently developed a streamlined liquidity process which requires only that the hedge fund investor volunteer as a live target for NYPD taser practice.

Check’s in the mail!

Are hedge fund managers really as smart as they are rumored to be?

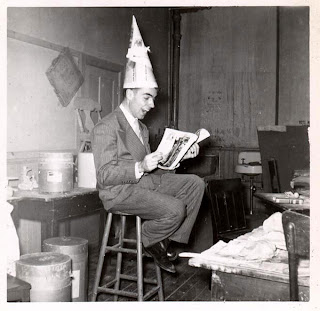

Yes. Three facts: 1) Bill Gates started Microsoft because he couldn’t get a job at a hedge fund. 2) Hedge fund analysts who make mistakes are often demeaned by being forced to sit on a high stool in the corner wearing a cone-shaped cap that says “MIT Physics Professor” on it. 3) When legendary rocket scientist Werner von Braun screwed up, his colleagues would mock him by saying, “Von Braun? Ha! He’s no hedge fund manager.”

“Great ideas–Phlogiston. Ether. Subprime CDOs.”

OK, then how did the Bear Stearns hedge funds lose money?

They didn’t lose money; they just got “marked down”.